Rent a AF DX Fisheye-Nikkor 10.5mm f/2.8 G ED in Lancaster, PA (Near Harrisburg & Philadelphia) Central PA – Perfect Image Camera

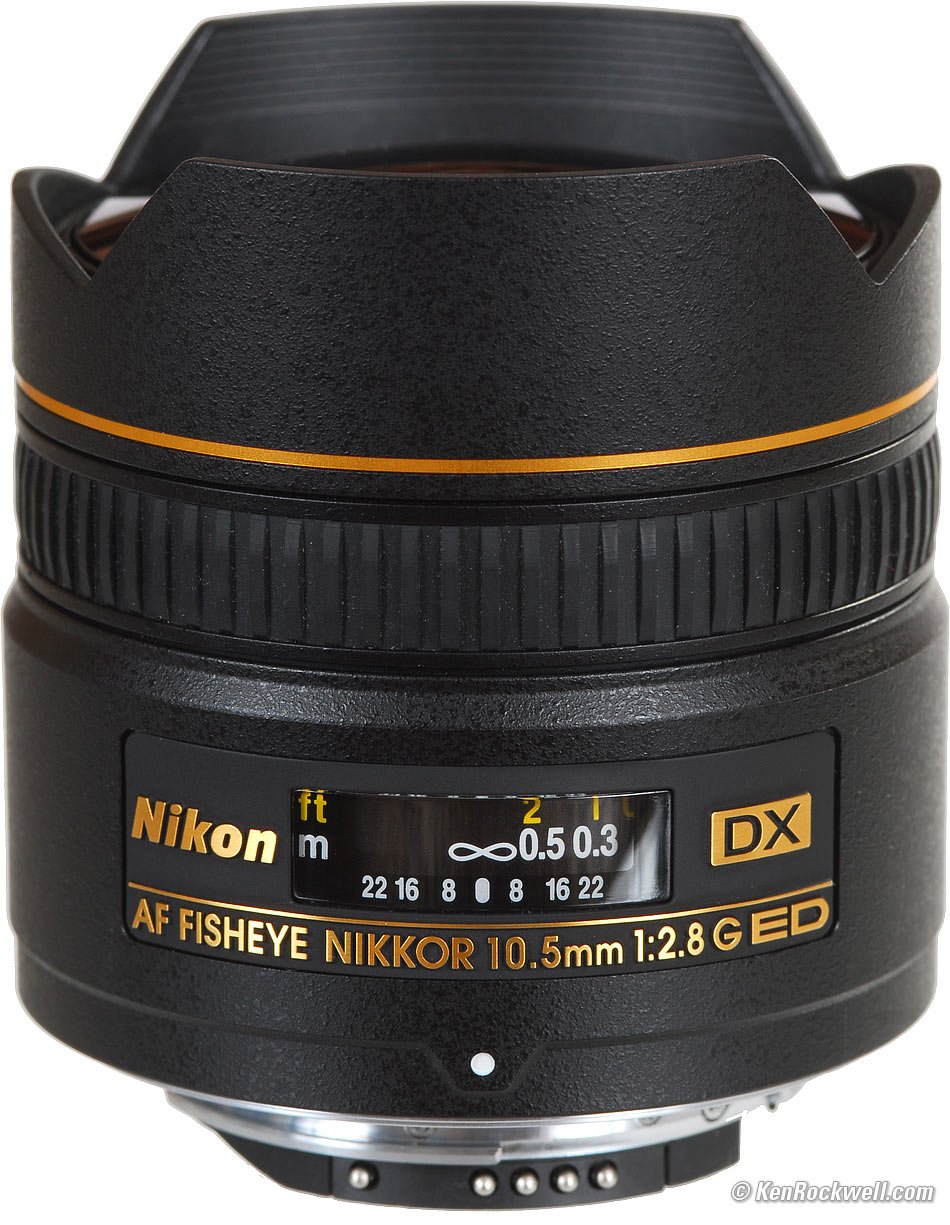

Nikon's Fisheye Lens? Expect Superb Optics and Craftsmanship | Learn Photography by Zoner Photo Studio

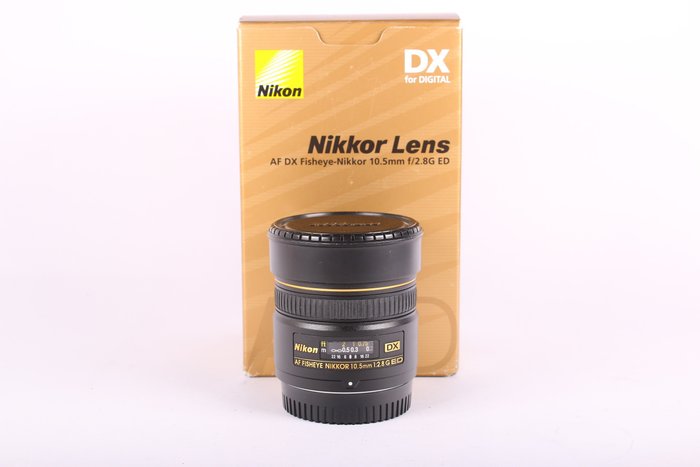

Nikon AF DX Fisheye-Nikkor, 10.5mm f/2.8G ED Lens, Nikon SLR Cameras | Fisheye-Nikkor Buy, Best Price in Qatar, Doha

Nikon AF DX Fisheye-Nikkor, 10.5mm f/2.8G ED Lens, Nikon SLR Cameras | Fisheye-Nikkor Buy, Best Price. Global Shipping.