Amazon.com: AMZWDMI Motorcycle Chrome Black Slotted Brake Clutch Levers For Harley Dyna Super Glide Softail Sportster 1200 883 touring Street Glide (Color : Black) (Color : Black) : Sports & Outdoors

Koupit Cnc hliníkový fotoaparát klec pro fujifilm x-t3 /xt3 /xt2 /x-t2 dslr fotografování stabilizátor plošinu ochranné pouzdro quick-release < sleva ~ www.kscm-jicin.cz

Cnc slitiny klec fixní držák pro 1/5 hpi rovan kingmotor mcd gtb racing baja 5b ss truck rc auto díly Výprodej \ Dálkové ovládání hračky < www.siti-sen.cz

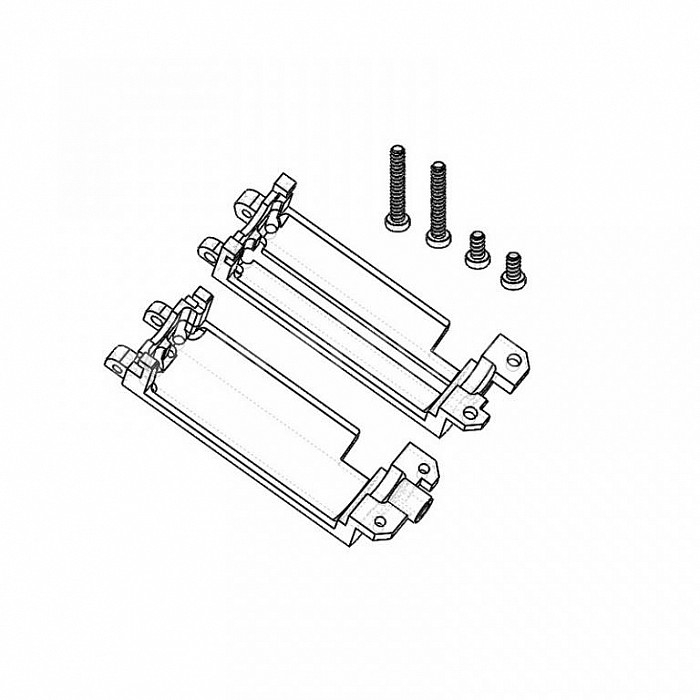

![CNC motorová klec pro AK [SHS] CNC motorová klec pro AK [SHS]](https://www.airborne-ranger.cz/i/shop/items/572/572.jpg)